The transformative power of sovereign wealth funds across world markets is one of the key features of the past two decades of international investment activity. Enabling economies and companies to realize new innovations and capture emerging trends, these funds often require a level of coordination of competencies that places management and business acumen at the center of the action, creating markets and finding opportunities to actualize the variety of potential investments on the horizon.

Rayo Withanage, the founder and Chairman of the BMB Group, is such a financer, weaving international funding from high level sources across the Middle East and Asia to develop new platforms.

Starting in Brunei, the BMB Group has since expanded to the Middle East, combining the funds of various royal families using a multilateral, multifamily format that harnesses the united synergies of the seed funding to create an institution that is a powerful, meaningful partner to companies and governments across the globe.

In a discussion of influences and major players that impacted Rayo Withanage’s views on finance and investing, we learn about a range of luminaries from the worlds of high finance and international relations.

Broadening the conversation from this point, we learn about Withanage’s family influences and his background in international finance.

Describing both the technical aspects of finance as well as his father’s strong moral ethics, Rayo Withanage gives us a glimpse into the driving spirit behind the BMB Group as well as how Withanage positions his business philosophy in a world where trust and honesty are equally important currencies.

Called “Virtue Capitalism” Rayo Withanage explains the philosophical underpinnings, practical applications, and broad application of his investment and financial strategies with references to a vision that is inclusive, sustainable, and, of course, profitable as well as mutually beneficial for all parties involved.

From here, we round out the discussion with talk about “deals that got away” as well as some of the disappointments and setbacks Rayo encountered along the path to success.

We also talk about how he overcame these challenges before finishing with a brief overview of a day in his life.

Can you provide an overview of your role and responsibilities as the Founder and Chairman of The BMB Group?

My main role at the start of BMB was to bring together senior members of royal families from Asia and the Gulf to work together to form a powerful private investment institution. From our beginnings in Brunei, we expanded to develop our relationships around the world and move our base of operations to the UAE. My role today is the development of new platforms.

Mr. Rayo Withanage with his father Mr. Rahula Withanage

How did your journey lead to the establishment of The BMB Group, and what inspired you to create the company?

The BMB Group was established at a time when Asian and Middle Eastern sovereign investors were starting to make significant acquisitions internationally.

We initially sought to develop a strong private investment institution for Brunei, but soon realized the power of a multi-family / multi-lateral format. This led us to become an important partner to key investors and heads of government throughout the Middle East and Asia.

BMB launched SCEPTER Partners for special business operations. Can you elaborate on the key areas of focus and expertise within that organization?

Scepter was established by one of our family offices that has over $14Billion in assets. It was a partnership with the Blackstone Asia Advisory business led by Anthony Steains in Hong Kong. Scepter was set up after 8 years of BMB’s operations, with the purpose of focusing on proprietary trading and large cap transactions. Scepter has since evolved into a prominent private family office.

As the Founder of BMB Group, who influenced your approach to business and leadership?

BMB taught me a lot about different business cultures and put us in the crossroads of incredible people. An early influence was Moeenuddin Ahmad Quereshi, the former Prime Minister of Pakistan and Head of the World Bank. Moeen founded EMP Capital, which was bought by BMB in 2008. Moeen formed an incredible advisory board that included: Chris Patten, Ratan Tata, Toyoo Gyoten, Bill Cohen and invited Henry Kissinger as speaker. Many of these people were incredible early influences on Their Royal Highnesses and me. Our core stakeholders have since become important leaders in our respective countries, having learned from such brilliant minds over the years.

What motivated you to venture into the financial industry?

I was inspired to begin a career in finance by my father, who is a well-regarded chartered accountant and CFO. For most of his career, he worked for Deloitte and Touché International. He worked across multiple countries including Fiji, Bermuda, New Zealand and Brunei. During his consulting assignments for the World Bank and Asian Development Bank, I had the privilege of traveling with him to some of the most unique places. I got to observe, from a very early age, my father’s involvement in multiple facets of finance and business operations. I was very much inspired by my father’s unwavering integrity.

Mr. Rayo Withanage with his father

As the Founder and Chairman, what is your vision for the future of BMB and SCEPTER, and what steps are you taking to realize that vision?

My vision for BMB is to develop new projects that add value for humanity. I would like to move on to run these new platforms and leave the traditional finance path to others. We are looking to create a new private development organisation that sponsors innovative multilateral initiatives across the world. The aim is to focus on businesses that are established to address some of the most pressing challenges facing the world today. Scepter will continue to be a family office and meaningfully develop wealth and impact for its clients.

How do you balance the pursuit of profit with social and environmental responsibility within your organizations, particularly in today’s climate of increasing corporate social responsibility?

A core component of our business strategy is to develop what we term as Virtue Capitalism. This is an economic model where for-profit businesses are established with the express purpose of solving pressing global challenges. Virtue Capitalist businesses disrupt traditional business models by finding solutions to social and environmental problems and using these solutions to differentiate themselves from traditional businesses. Virtue Capitalist businesses seek to provide better alternatives to existing product offerings and become competitive market leaders that meaningfully assist partner charities and foundations. We have spent over a year working in the R&D phase to develop technologies and business processes that we feel can make a difference. We are excited to announce ventures in the new year.

Is there a deal that got away?

There was a company I tried to buy for several years. One of Australia’s largest oil and gas companies. I worked with an advisory partner to try and buy the company… twice! We raised over $12.5 billion and engaged with the chairman of the company for over a year.

At one point we partnered with another private equity firm to achieve the acquisition, which was reported in a financial review. Sadly, the deal fell apart, despite spending a lot of time and money to make it happen.

I don’t view this as a deal that “got away,” because it ended up being an incredible experience that taught me many valuable lessons. It upleveled my skills on putting together large scale deals, negotiating, building business relationships, learning to determine when and how to focus on the right things, and working with advisors. The growth I and my team experienced during that time has been highly valuable.

What is something that disappointed you in your career?

I have had the privilege to work with some amazing people throughout my career. I have not always agreed with my colleagues and we have had disagreements, but I can say that all my close partners have retained mutual respect.

Once I hired someone who wasn’t committed to the vision my team and I have for the research and development of funding charities. Unfortunately, it was a hard lesson to learn that not everyone cares about work ethic and considering how their actions will affect others.

What advice would you give to aspiring entrepreneurs and business leaders based on your own experiences and the journey you’ve had with SCEPTER Partners and BMB Group?

I would advise entrepreneurs to understand their skill set very carefully. It is important to have self-reflection to understand what you are good at and surround yourself with people who are different to you, who can challenge you, and cover your weaknesses. I would then encourage that person to find something they are passionate about and to always have conviction in themselves.

The universe rewards those who are brave enough to try and reach their goals, so never give up. Continue to adapt and understand risk. Stay in the game and keep your heart light. Never stop being amazed by the world. It is tremendously beautiful and our time in it is short. If you are happy, you will spread this to others.

The Picasso Estate

Mr. Withanage, you purchased the Picasso Estate, located on the French Riviera, in 2017. What spurred you to make such a purchase?

I was always drawn to the immense creative energy at the estate, not only from Picasso’s time at the estate and all its prior history, but also in the creativity it inspires in people until today. Throughout the 20th century and the time of Benjamin and Bridget Guinness, the estate welcomed illustrious celebrities and some of the most important creative figures in history including Henri Matisse, Man Ray, Salvador Dali, Joan Miro, Winston Churchill, Ernest Hemingway, F. Scott Fitzgerald, Charlie Chaplin and the Rolling Stones.

Of course, Picasso was incredibly productive during his time at the estate, creating most of his work from the ‘later period’ drawing inspiration from the large villa, expansive Mediterranean gardens, and magnificent view of the Bay of Cannes and the Estérel mountain range. The estate has always been a source of inspiration and peace. After spending time there, I knew I had a role in preserving the essence of the estate as a sanctuary, and a place that has celebrated life for over a thousand years.

How do you imagine your ownership of the estate will contribute to its legacy and that of the famous painter?

I have never seen myself as the owner of the house, rather a custodian of a living piece of history. I’ve always viewed the estate as a place that celebrates life. My main goal for now is to ensure the estate is relevant to the most important creative developments of the present and the future. It needs to be a place that is a force for good. I have decided that the main house will remain private. We have received all sorts of proposals to turn the house into a hotel or club which we turned down. We are evaluating proposals that can preserve the unique spirit of Château De Vie.

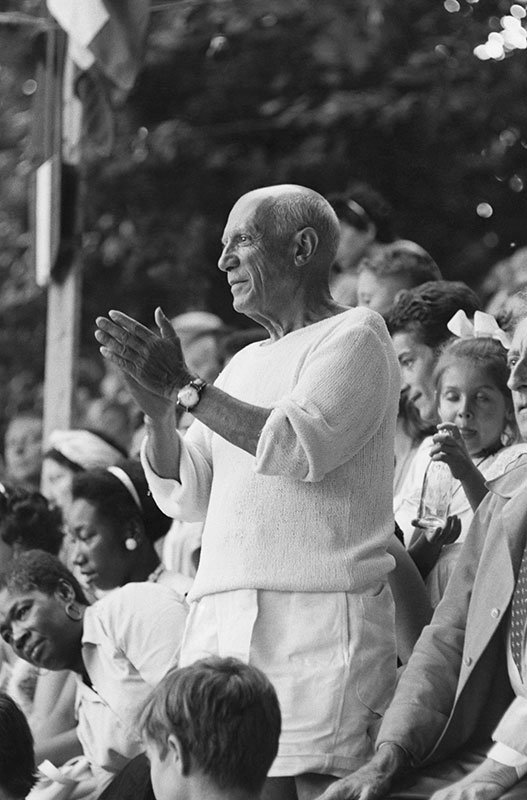

Pablo Picasso

How has Pablo Picasso’s work influenced your vision of the sprawling estate? What does the future hold for the property?

I would like to return it to a space that produces art once more, to keep its history and heritage alive given its importance to Picasso’s work and two major art periods.

Picasso’s time at the estate was a huge part of the growth and transition towards a new style and generation of artists, and I would very much like to honor this. We are exploring different businesses that can be developed at the estate, focusing on the intersection between art, cultural conservation and technology.

Château De Vie-The Picasso State

Mr. Withanage, how is a day in your life?

My work is my passion, so I relish working as much as my hobbies. I spend my first half of every day planning how we can execute and do things better. I spend the second half executing what we have decided to do. I have my daughter who lives with her mother in Geneva, so my favorite time of every month is the 10 days I spend with my little one.

What is something most people don’t know about you?

I love singing and acting and wanted to be a performing artist when I was younger. I was the solo singer in my school’s jazz band for a few years.

I did not have enough money at that time to support my family, and that was very important to me, so I went into business. I also love travel and comedy. I have travelled to over 100 countries and speak six languages. I enjoy laughing, principally at myself. I think I got that self-deprecation growing up in New Zealand. I think too many of us take ourselves too seriously. A life without color and humor would be sad.

Choose two of your favorite quotes and write them here

“The meaning of life is to find your gift. The purpose of life is to give it away.” Pablo Picasso

“Success is not final; failure is not fatal: It is the courage to continue that counts.” Winston S. Churchill

If you had the power to change just one thing in the world, what would it be?

To eradicate suffering in all forms, especially that which is caused by poverty, inequality and conflict.